The Best Guide To Accounting Franchise

Table of ContentsThe Ultimate Guide To Accounting FranchiseThe Accounting Franchise PDFsAccounting Franchise Can Be Fun For EveryoneAll About Accounting FranchiseFacts About Accounting Franchise RevealedLittle Known Facts About Accounting Franchise.How Accounting Franchise can Save You Time, Stress, and Money.

By dealing with these details requirements, franchise business services can keep precise financial records, satisfy legal obligations, and guarantee the effective operation of their franchise locations. The relevance of utilizing a certified franchise business accounting professional can not be overemphasized when it pertains to franchise bookkeeping. Accounting Franchise. Franchise services operate under an unique collection of economic scenarios and guidelines, making it crucial for franchise owners to have an accounting professional that comprehends the complexities of this business modelFranchise accounting professionals completely assess the financial obligation framework, including outstanding finances and rate of interest prices, to determine possibilities for refinancing or working out far better terms with lenders. Lower-cost choices can significantly influence the franchisee's financial wellness and overall productivity.

Rumored Buzz on Accounting Franchise

Their competence in economic evaluation and financial debt management allows them to recommend franchisees on the most effective strategy. Enhancing organization efficiency entails continually adjusting strategies to align with financial goals. Franchise accountants help franchisees comprehend the monetary ramifications of different debt management methods and help in executing them successfully.

A Biased View of Accounting Franchise

It helps franchise business proprietors remain on top of their monetary placement and take timely actions to make certain good money circulation. Finally, the biggest approach to guarantee great capital in franchise accountancy is to maintain to a budget. By determining and classifying recurring and unforeseeable expenses, producing a money circulation statement, and utilizing a cash money circulation dashboard, franchise business owners can properly handle their funds and guarantee the success of their organization.

The franchisor is like a not-so-quiet partner in a franchise venture, which means they have the right to audit your bookkeeping documents any kind of time they suspect something is amiss. Even if all they discover is an audit mistake or 2. Being a franchisee additionally suggests that you must abide by the franchisor's audit standards.

From the franchisor's monetary health and wellness to the initial financial investment called for, ongoing charges, and also litigation history, the FDD uses an extensive explore the franchisor-franchisee connection. Recognizing the FDD is vital for new franchisees, as it equips them to make educated choices concerning their investment (Accounting Franchise). By evaluating the record, prospective franchisees obtain clarity on the threats, obligations, and prospective benefits connected with signing up with the franchise system, guaranteeing they participate in the collaboration with eyes wide open

How Accounting Franchise can Save You Time, Stress, and Money.

Franchises typically have ongoing royalty charges, advertising and marketing charges, and other prices not typical of independent companies. Most importantly, you'll desire to make sure you know all of the franchise charges you'll be subject also. Second of all, you'll wish to make certain these costs are included in your anonymous financials, and make sure your bookkeeper or accountant knows too.

New franchisees should focus on comprehending the tax obligation effects connected to franchise business charges, aristocracies, and various other ongoing settlements to the franchisor. Accounting Franchise. In addition, new franchisees ought to also recognize state and local tax legislations governing their procedures, consisting of earnings tax, sales tax obligation, and work tax obligations. When you have a franchise business not just will be you in charge of keeping care of its books, but make sure it's operating legally

The Greatest Guide To Accounting Franchise

Understanding these conformity needs is particularly essential considering the charges can impose pricey fines. Numerous local business owner and franchisees begin thinking they can do it all on their own. Nonetheless, really promptly, they understand, they're spread as well thin. As opposed to caring for your very own publications, it pays to hand them off to specialists.

It's something to have your financials produced each month, it's another thing to comprehend them and make use of the numbers to your advantage. When you start off as a brand-new franchisee, it is necessary to create a solid foundational understanding of monetary statements (earnings & loss, balance sheet) to keep track of performance.

From the beginning, establish a system for monitoring receipts, invoices, and other financial papers for tax and reporting objectives. This is typically done in accounting software program, where accessibility is after that provided to an accounting professional to keep an eye on and generate records for month-to-month monitoring. Talking of records, remaining in song with and in addition to your funds and estimates is another way to stay effective and range.

The Single Strategy To Use For Accounting Franchise

Again, we can not stress this adequate. Do not think twice to seek support from a certified accounting professional with franchise experience. Whether it's tax obligation preparation, accounting, conformity, or various other areas, outsourcing tasks that you're not an expert in will certainly allow you to concentrate on the daily procedures while the specialists handle the remainder.

If you want helping browse around this web-site other organizations improve their operations and profits while constructing your own effective organization, then starting an audit franchise may be a great fit for you. When you start an audit franchise, not only do you get assistance and a highly regarded name support you yet you additionally can feel great that you'll be using a look what i found proven company design as opposed to going back to square one.

Accounting franchise business provide a number of different services including however not limited to accounting, tax obligation preparation, payroll, expenditure decrease, funding aid and funding, invoicing, economic consulting, and more. Some accountancy franchise business concentrate on one category while others may supply a suite of solutions. Many services will certainly have a standard understanding of the classifications detailed above, they typically don't have the time or resources to manage them as properly as possible.

About Accounting Franchise

Depending on your goals, you could work part-time, full time, or a mix. Functioning from another location also provides you the chance to deal with a range of clients that may or may not be in the same city as you. Given that lots of audit franchise business are run remotely, franchisees don't require to rent out office or pay for energies at a separate location from their home.

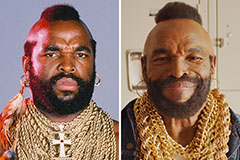

Mr. T Then & Now!

Mr. T Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now!